Supporting Bridgepoint Development Capital’s Acquisition of Inspired Thinking Group

Supporting Bridgepoint Development Capital’s Acquisition of Inspired Thinking Group

Commercial due diligence: AMR highlights significant opportunities for high quality technology-led assets

The deal

Bridgepoint Development Capital acquired a majority stake in Inspired Thinking Group (ITG), a marketing campaign execution company providing print management and artwork production services, supported by MRM software (‘Marketing Resource Management’).

Key insights

- Marketing functions are increasingly outsourcing execution processes. This has been triggered by budget pressures and the increasing complexity of marketing; this is driving demand for specialists who can enhance efficiency

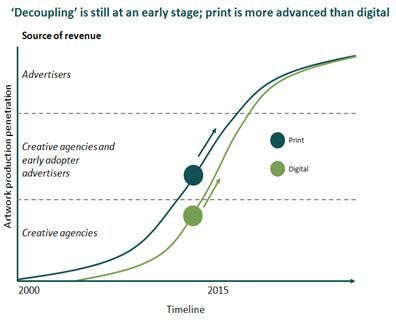

- There is a clear trend to take campaign execution out of costly creative agencies (often referred to as ‘decoupling’) and outsource these activities to specialist execution agencies

- The campaign execution market is growing strongly, and the rate of adoption is fastest in areas of high complexity and cost

- The campaign execution market is currently fragmented and silo-ed. Execution agencies with MRM (marketing resource management) software capability have a clear competitive advantage as it is a key route into upselling services, and becoming a one stop provider

- ITG is differentiated through a strong MRM software capability, print management expertise, and excellent customer service

So what?

The early stage nature of the market, coupled with the trend of marketing functions consolidating suppliers is creating significant opportunities for high quality technology-led assets.

How we helped

We supported BDC on its acquisition of ITG through a rigorous commercial due diligence process, including market, customer and competitive analysis.

Read More

All Rights Reserved | Stax LLC | Powered by Flypaper | Privacy Policy