Integrated Business Management Platforms: A Renewed Wave of PE Investor Momentum

Integrated Business Management Platforms: A Renewed Wave of PE Investor Momentum

Technological advancements, evolving customer preferences, and the need for cross-border and global capabilities are continually revolutionizing the payments industry. The end-customer’s demand for convenience, engagement, diversity of payment options and currencies, and security has significantly influenced transaction methods and how merchants process and receive payments.

As the digital transformation of merchant businesses persists, integrated business management platforms are leading the charge in innovation and disruption of traditional processes. Integrated business platforms primarily offer software that enables businesses (i.e., merchants) to manage their operations more effectively and seamlessly handle payment acceptance and disbursement. This integration of software and payments has not only created a more engaging and beneficial solution for merchants but also reshaped the vendor ecosystem in various end-markets, including food services, health and wellness, and e-commerce and retail.

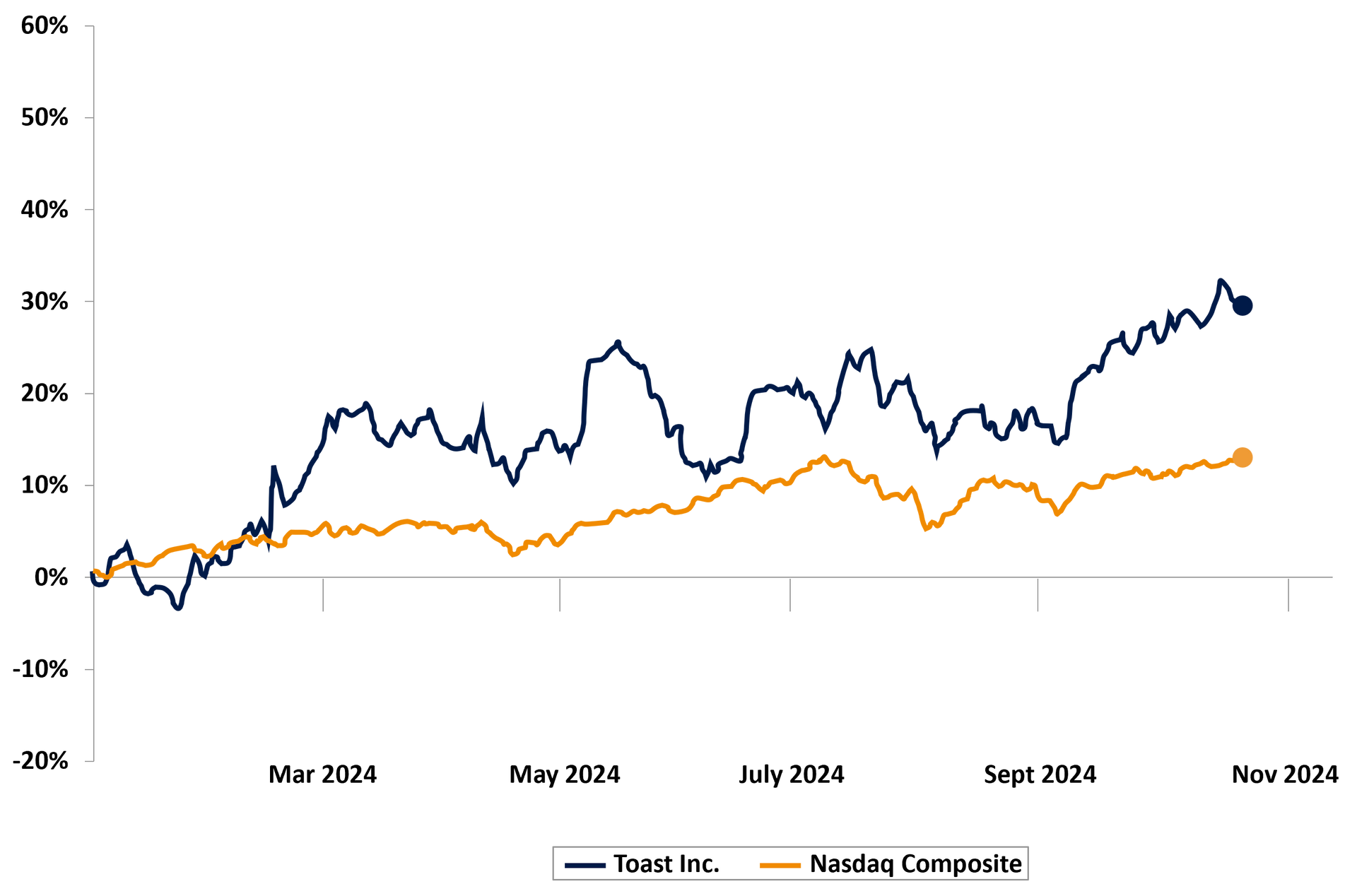

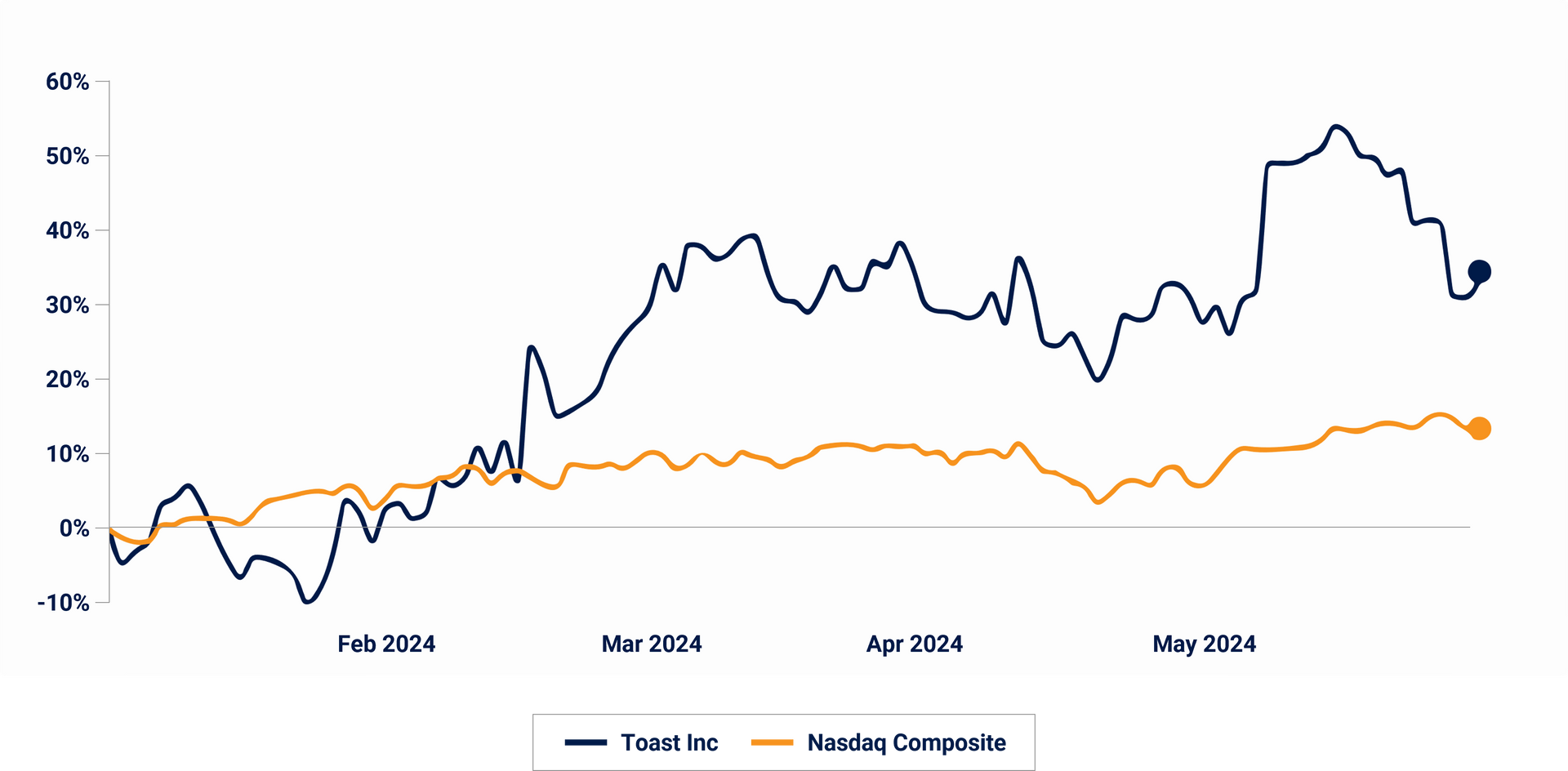

Integrated business platforms present investment prospects in a swiftly transforming environment that is poised to recover as the overall economic outlook becomes clearer. Looking at the public markets for instance, Toast has rebounded from its 2023 lows. Moreover, the expected introduction of ServiceTitan and other prominent platforms to the public markets might spark renewed enthusiasm among investors in both public and private companies. We will explore the market’s evolution, supporting demand drivers, dynamics, and implications for investors in greater depth.

Technological advancements and evolving customer preferences are continually revolutionizing the payments industry. The end-customer’s demand for convenience, efficiency, diversity of payment options, and security has significantly influenced transaction methods and how merchants process and receive payments.

As the digital transformation of merchant businesses persists, Independent Software Vendors (ISVs) are leading the charge in innovation and disruption of traditional processes. ISVs primarily offer software that enables small-to-medium-sized businesses (i.e., merchants) to manage their operations more effectively and seamlessly handle payment acceptance and disbursement. This integration of software and payments has not only created a more engaging and beneficial solution for its customer base but also reshaped the vendor ecosystem in various end-markets, including food services, health and wellness, and

e-commerce and retail.

This evolving trend presents investment prospects in a swiftly transforming environment that is poised to recover as the overall economic forecast becomes clearer. Looking at the public markets for instance, Toast has rebounded from its 2023 lows. Moreover, the expected introduction of ServiceTitan to the public markets might spark renewed enthusiasm among investors in both public and private companies. We will explore the market’s evolution, supporting demand drivers, dynamics, and implications for investors in greater depth.

Integrated Business Management Platform Evolution

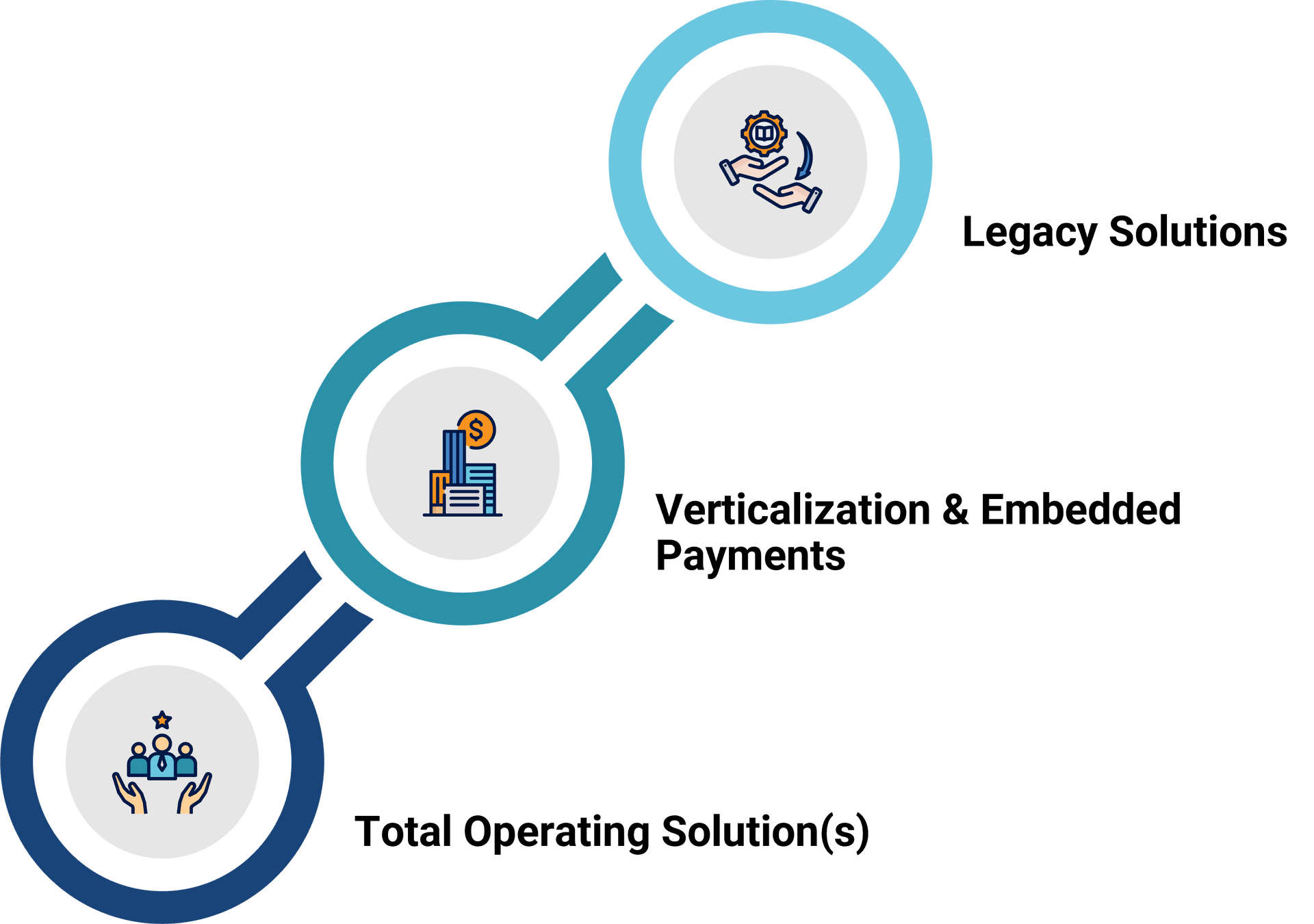

At Stax, we have been observing this market for three decades. The evolution of this market can be segmented into three key stages:

Legacy Solutions

Initially, legacy solutions were used, independent software systems that did not communicate or integrate well with other tools, leading to data silos and inefficiencies. For example, traditional point-of-sale solutions handled the acceptance and processing of cash and card payments. These machines, commonly known as dummy terminals, were large and unwieldy devices that functioned on closed networks with data stored on local servers. The POS systems were costly, requiring significant initial and operating expenses, and they were often difficult and complex to use. Furthermore, these traditional systems lacked the necessary customization to tackle specific industry challenges.

Verticalization & Embedded Payments

As merchants were undergoing a digital transformation, automating front-end and back-end processes to manage and support their business, integrated business management platforms developed software solutions that incorporated industry-specific functionality to manage their business along with payment functionality—they sought to help businesses manage their operations digitally and with ease.

For instance, field services businesses required industry-specific software that could manage projects, track costs, plan schedules, and handle service requests—all while processing payments. Within the restaurant industry, solutions like Toast expanded their offerings to include online ordering, digital storefronts, and marketing.

Integrated platforms developed solutions centered around the merchant, distinguishing themselves from traditional legacy solutions and consequently increasing their market share. The emphasis on efficiency and industry specificity, through their bespoke solutions, enabled them to swiftly capture market share.

Total Operating Solution

Today, we are observing the rise of comprehensive integrated business management platforms that act as total operating solutions. These platforms oversee a company’s daily operations and unify various business workflows such as payments, business management, and customer relationship tools, all while being tailored to specific industries. These platforms are enhancing their capabilities to deliver end-to-end business management capabilities, unlocking new revenue opportunities and increasing wallet share.

In a similar vein, merchants are looking to consolidate their software spend with a single vendor. This vendor consolidation provides merchants with a single point of accountability, streamlining operations, simplifying oversight, enhancing visibility and control, and reducing risk.

Growth Opportunities

Providers are evolving and broadening their capabilities to cater to the shifting needs of merchants and their end-customer, thereby providing continued growth opportunities for these providers. For example, integrated business platforms are increasingly offering value-added financial services such as lending, payroll, and corporate or virtual cards to help address customers’ capital needs. These providers are also embedding accounting capabilities to further enhance the functionality and value proposition.

As the customer base of merchants becomes increasingly digital and tech-savvy, providers are developing omnichannel solutions that unify in-store, online, and mobile experiences. This provides customers with a seamless journey across various channels. Likewise, these platforms need to guarantee payment flexibility by accommodating a wide range of payment options across traditional, alternative, and mobile platforms.

As merchants expand globally, the demand for facilitating international payments is growing. This includes accepting transactions in multiple currencies and complying with international payment regulations.

Finally, payment solutions are incorporating AI into their solutions to improve user experience and automate processes. For example, AI can be leveraged to enhance merchant onboarding, end-customer communication and engagement, as well as demand forecasting.

Searching for Investment Opportunities

When evaluating investment opportunities, it’s vital to pinpoint those platforms that have carved out a strategic advantage or ‘entry point’. This often begins with a key service, such as payment solutions, in a specific vertical. This approach enables providers to gain a solid foothold within their customer base, and over time, expand their capabilities to include other financial services and software functionality, further integrating seamlessly into customers’ workflows and operations.

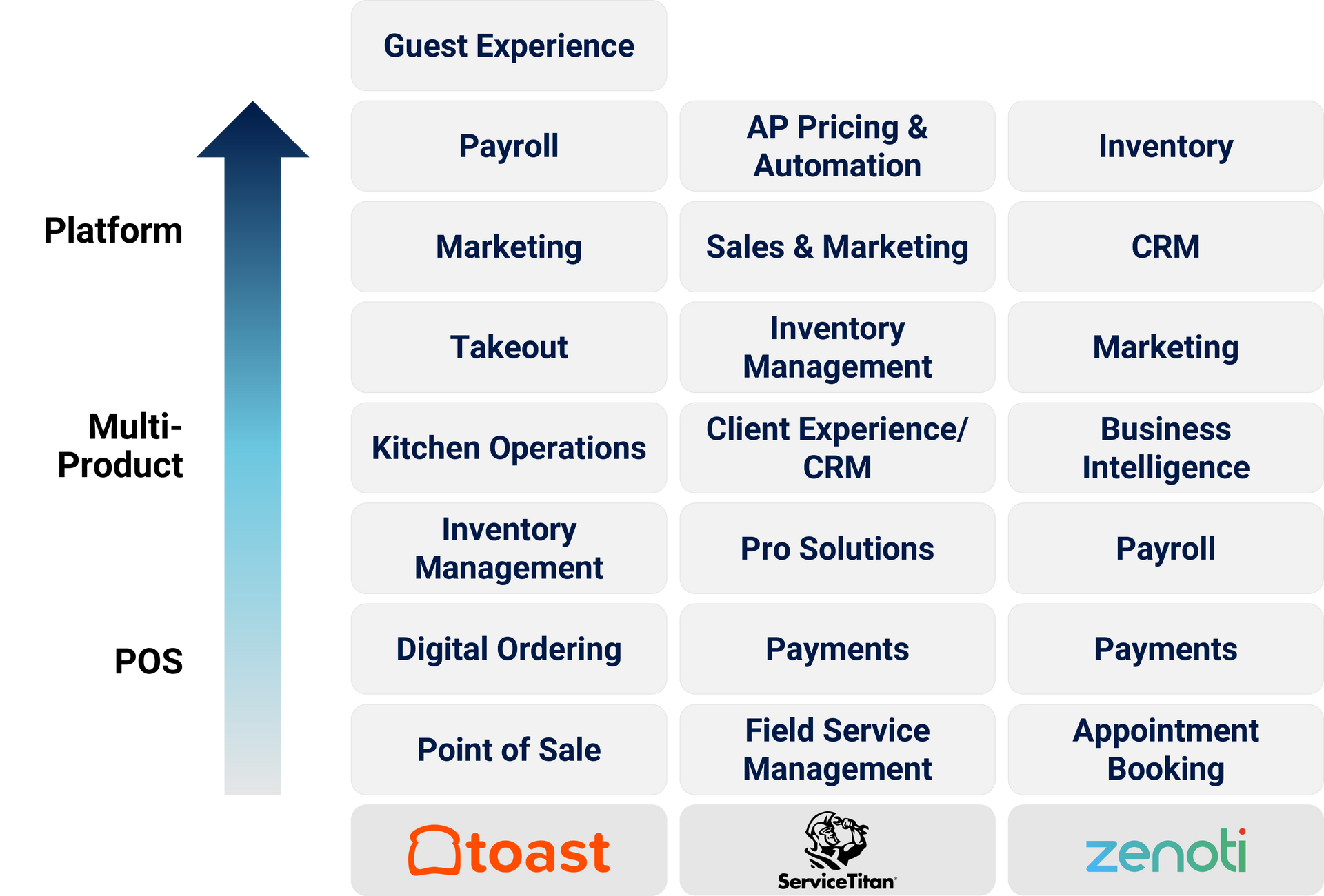

A case in point is Toast’s product evolution. The company has transitioned from a restaurant POS system to a comprehensive product suite encompassing operations, online ordering, delivery, and marketing, eventually becoming a platform and operating system for the restaurant industry. Toast can continue to harness its platform to deliver value to its customers. However, Toast isn’t alone in this regard. Both ServiceTitan and Zenoti have shown their capability to build a platform within their respective end-markets (these are not the only examples, as other companies are also successfully creating operating systems in various industries).

As demonstrated by these companies, this strategy not only gives a competitive advantage but also lays a solid foundation for sustained long-term growth.

Investment Insights

The ongoing evolution and expansion of integrated business management solutions presents a variety of options to investors. As the U.S. market matures, several providers have entered the public markets. As some companies’ valuations remain under pressure, there may still be potential for privatization.

Investors must also refine their strategies to spot the next wave of emerging companies. This strategic pivot necessitates a deep understanding of market trends and the ability to identify future niche sector leaders, demanding investors to stay updated and adaptable in their investment approach.

Investors stand to gain by identifying niche markets that are quickly adopting business management platforms and may be ready for consolidation. Additionally, investors might explore the possibility of aggregating and consolidating multiple assets in attractive end-markets or verticals to achieve greater scale.

Lastly, successful investment strategies in the U.S. may also be applicable internationally. The European market is earlier in its stage of development compared to the U.S. market and presents opportunities for growth. The ability to scale internationally will be an important investment consideration for all assets.

About Stax

These integrated business platforms are representative of a significant shift within fintech and the broader financial services sector. For investors, staying ahead of this trend requires understanding the role of business platforms, particularly those tailored to specific verticals. As this sector continues to expand and evolve, the investment opportunities it offers are considerable.

When it comes to understanding the viability of a market for investment,

Stax is where value is created. Our approach, centered around providing data-driven and actionable insights, enables clients to make informed decisions that lead to providing the most competitive returns. To learn more, visit our website

www.stax.com

or

contact us here.

Read More

All Rights Reserved | Stax LLC | Powered by Flypaper | Privacy Policy