Leveraging Data Across the PE Lifecycle

Leveraging Data Across the PE Lifecycle

In Stax’s experience working with PEs and their portfolio companies, most organizations already capture a wealth of data. However, their shortcomings often lie in how they harness this data to derive actionable insights.

Many companies will only utilize a few select data sets for insight generation, others will fixate on implementing tools/technologies without consideration for the outcomes required, and yet others will work with poor quality data to drive business decisions. In each of these scenarios, the full potential of the accessible data is not being realized and the result is poor decision making.

A typical portfolio company (PortCo) can unlock significant value by directing their attention toward understanding its customers, markets, and operations through the data it already possesses. By implementing a select set of interventions at various stages of a PortCo’s lifecycle, valuable insights can be swiftly gained without necessitating extensive effort or investment.

Diligence

At the diligence stage, data analysis can help PE refine the overall valuation while identifying risks and areas of opportunity with the investment. However, not enough PEs leverage the full potential of data analytics during diligence. Here are two areas where we’ve seen value delivered with minimal effort:

Rapid insights for deals

Stax has helped deal teams structure their thinking, identify key questions for diligence, and refine their investment hypothesis utilizing insights generated using the Stax Rapid Insights tool. During a deal, Rapid Insights can be easily implemented to visualize data shared by the target, providing insights on customers, products, and operations to create a picture of the overall health of the company.

Customer Sentiment Analysis

Regarding the target and its products or services, analyzing online reviews can provide private equity firms with valuable insights. This information can shed light on crucial aspects like customer loyalty, competitive positioning, and potential areas for enhancing the customer experience. These insights, in turn, can serve as a foundation for shaping initiatives throughout the hold period. Understanding customer sentiment will provide a contrast against the data shared by the target, helping to validate whether the overall narrative presented by the target is accurate. Stax’s work on sentiment analysis has proved continuously popular with our clients, particularly with B2C.

First 100 Days

The initial 100 days are critical for any new investment. The insights gained during diligence should be used to inform plans for value creation, from quick wins that yield immediate outcomes to more far-reaching transformative changes. Yet, many operations teams will start from scratch without leveraging the data that was already gathered during diligence. A few ways to avoid this include:

- Rapid Insights for PortCo Monitoring – If Rapid Insights was utilized at the diligence stage, extending it to include new data sets which are now available post-acquisition is a low effort activity. New, detailed insights can be gathered around customers, products, and operations, helping the operations team pinpoint where to focus effort in the first 100 days and beyond. The ability to visualize data and drill down into details using the Rapid Insights portal enables teams to quickly understand the newly acquired company’s ground realities. It also provides PE with an objective basis for decision making, reducing the influence of any pre-existing biases PE might hold about their new PortCo.

- Data Maturity Assessment – A data maturity assessment (2-3 weeks) covering the data assets, infrastructure, and skills of the PortCo provides insights into the current accessibility, comprehensiveness, and health of data within the organization. This assessment determines the PortCo’s current positioning on its journey towards becoming a best-in-class, data-driven organization and provides the basis from which transformational initiatives can be identified.

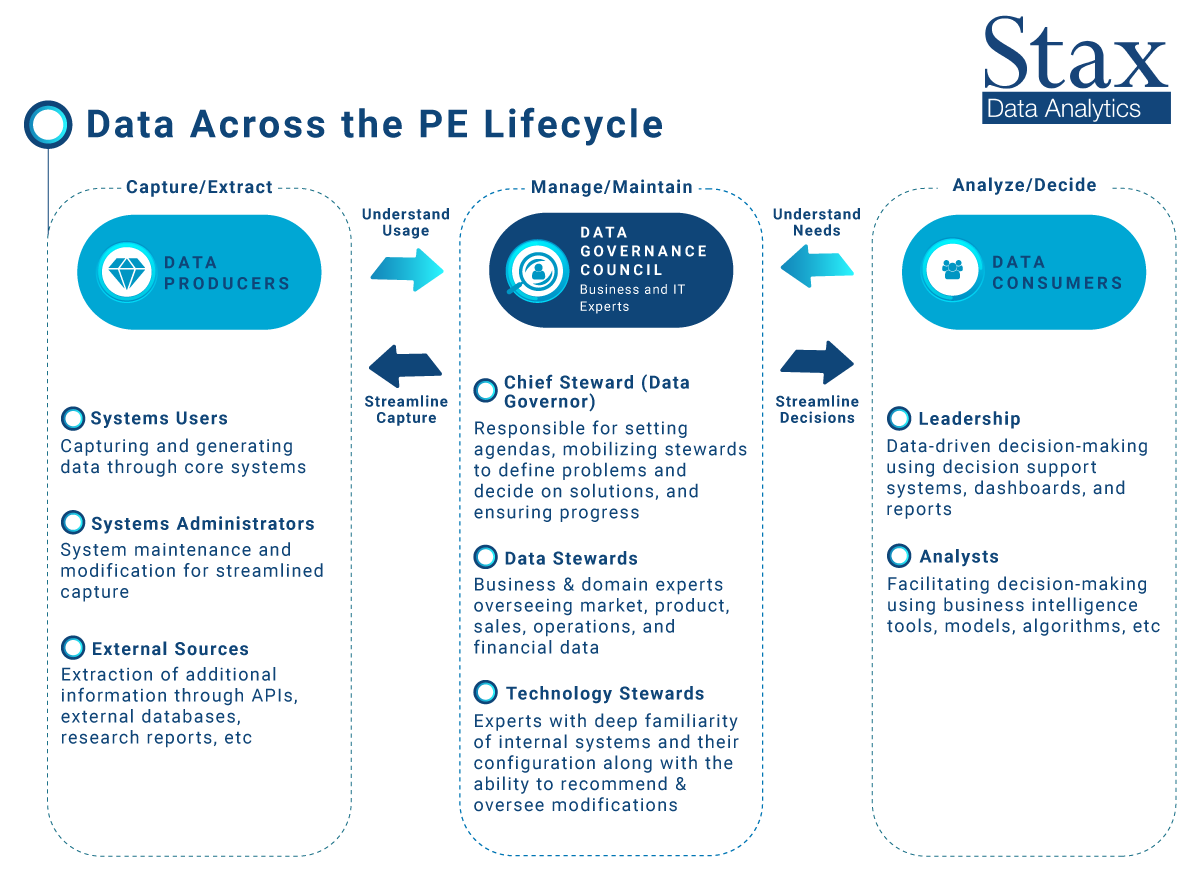

- Data Governance Council – Once the maturity assessment identifies transformational initiatives, sustaining these efforts can be challenging without suitable policies, processes, and change management. Before launching into any business intelligence initiatives, a PortCo should establish a Data Governance Council comprised of a data governor, data stewards, and technology stewards. Members of the Council should be influential within the organization, taking accountability for monitoring, maintaining, and enhancing data.

Value Enhancing Hold Period

Stax recommends focusing on a select few business-outcome driven initiatives during the hold period. This avoids the need for large-scale, multi-year transformation efforts which don’t typically provide value to the business.

Managing data quality

Many organizations operate utilizing multiple systems and files that contains missing values, errors, inconsistencies, and redundancies. Working with poor quality data leads to poor decisions, impeding value creation efforts. Stax’s Quality Enhancement and Standardization Tool, or QUEST, is designed to assist organizations with proactively identifying and addressing these data quality issues. QUEST empowers the newly established Data Governance Council to ensure data is accurate, relevant, complete, and consistent, improving time to value and accelerating outcomes by allowing transformation efforts to focus on specific domains or use cases.

External data enhancements

The ability to benchmark the PortCo’s performance within the context of the broader market can help management immensely. To do so, it’s necessary to enhance the PortCo’s data with market data which can be obtained from various external sources. Integrating external data with the PortCo’s data can be a simple activity, provided the PortCo has removed internal siloes and consolidated their data. Various new analyses can be constructed out of the combined data, providing insights into both the PortCo’s overall performance as well as how it compares to its peers and the wider market.

Enabling new C-Suite executives

Our experience has also shown that although it is common for a PortCo to undergo leadership changes during the hold period, many incoming leaders are not adequately supported. They are not provided with the right toolkits and skillsets to be able to quickly understand the current state of the business, pinpoint issues, and launch targeted initiatives to generate value. As a result, most new leaders can struggle to perform well. At Stax, we have supported new CXOs in their first 90 days by providing a SWOT team of analytically skilled individuals who can design, implement, and maintain solutions that provide insights to help the new CXO address their immediate goals and priorities.

Exit Planning

Finally, at exit planning, value resides in the ability to articulate a clear story on the stability and the trajectory of a portfolio company as well as the size of the untapped market and how ready a PortCo is to exploit it.

Stax has supported PortCo’s providing a compelling narrative around how they acquire new higher value customers at lower costs while also cross-selling and up-selling to their existing customer base more effectively and efficiently. Rapid Insights in particular, can improve this process by providing a readily available visualization mechanism that can be shared with potential investors to help them review and interrogate the company’s data thoroughly.

By focusing on one or more of the interventions described above, a typical PortCo can gain outsize value from its existing data without the need for undertaking any long-term, high investment transformational activity. The results from these changes compound over time to eventually enhance valuation at the time of exit, providing leadership teams with a successful outcome.

Read More

All Rights Reserved | Stax LLC | Powered by Flypaper | Privacy Policy