Navigating Enterprise Software Challenges: A Second Half Rebound

Navigating Enterprise Software Challenges: A Second Half Rebound

While the first half of the year has been tough for enterprise software providers, the outlook for the second half of 2023 appears more positive and may show signs of a rebound.

Transitioning into the second half of 2023, the initial six months posed significant challenges for many enterprise tech companies. A deteriorating macroeconomic climate drove mid-sized and large-sized firms to cut IT budgets. CIOs spared core enterprise applications (i.e., Salesforce, ServiceNow, Oracle, Workday, etc.), but pared back spend elsewhere on critical solutions that were ranked lower in the tech stack—workflow collaboration, automation, sales management, revenue operations, customer engagement—as a few examples.

End-customers reined in their own topline growth expectations and accordingly took actions to reduce operating costs, including software spend by reducing seat count, downgrading plans, cutting demand for cross-sold products, and/or canceling their subscriptions. The push to cut costs challenged a longer tail of enterprise software providers to keep topline growth forecasts in line with previous forecasts. Consequently, both public and private enterprise tech companies faced greater difficulties in meeting topline targets in the face of these macro headwinds.

However, this spending slowdown has been and remains short-term in nature; mid-term and longer-term enterprise software demand drivers remain intact. The economy remains resilient, and confidence is building that the widely anticipated recession and a corresponding ~5% unemployment rate will not materialize. According to Google, web searches for “recession” are tumbling.

As the macro economy moves from the foreground to the background, investors are getting off the sidelines and becoming more comfortable putting capital at risk, and there is renewed interest in those enterprise software businesses that have previously fallen out of favor.

In Q3 - Q4 2022, those macro headwinds surfaced, which impacted software providers’ FY2022-2023 renewals. Those macro pressures are not only bottoming but also the economic picture is more optimistic heading into the FY2023-FY2024 contract renewal period. Customers may once again resume spend in FY2023-2024, and these "less critical” enterprise software providers will start to lap those macro effects that have negatively impacted them a year ago.

Additionally, CIOs continue to face shortages of available talent, increasing demand for scalable solutions that allow them to operate with fewer employees—supporting continued investments in those other categories (i.e., workflow collaboration, automation, sales management, revenue operations, customer engagement, etc.).

An Evaluation of Investment Opportunities in a Sales Tech Platform

For example, Stax recently supported an investor client to evaluate an investment opportunity in a sales tech platform. The investment target had previously demonstrated a track record of continued topline sales growth, supported by new customer acquisition and net retention revenue. Historically, the investment target had retained existing customers and had grown revenues via seat expansion and/or upsells. However, as enterprise software budgets were under more scrutiny and experiencing slower growth, our client required a more detailed viewpoint.

Our client’s investment decision required delivery of insights into these key questions and considerations:

- How mature is the market and what is the associated whitespace?

- How differentiated was the target company’s solution and what was its right to win in the market?

- How entrenched are customers?

- What is the risk of customer churn or displacement at renewal?

Based on Stax’s deep experience supporting more than 300+ transactions annually and our industry experience in technology, Stax designed a multi-stream effort to understand the market, customer, and competitive dynamics occurring.

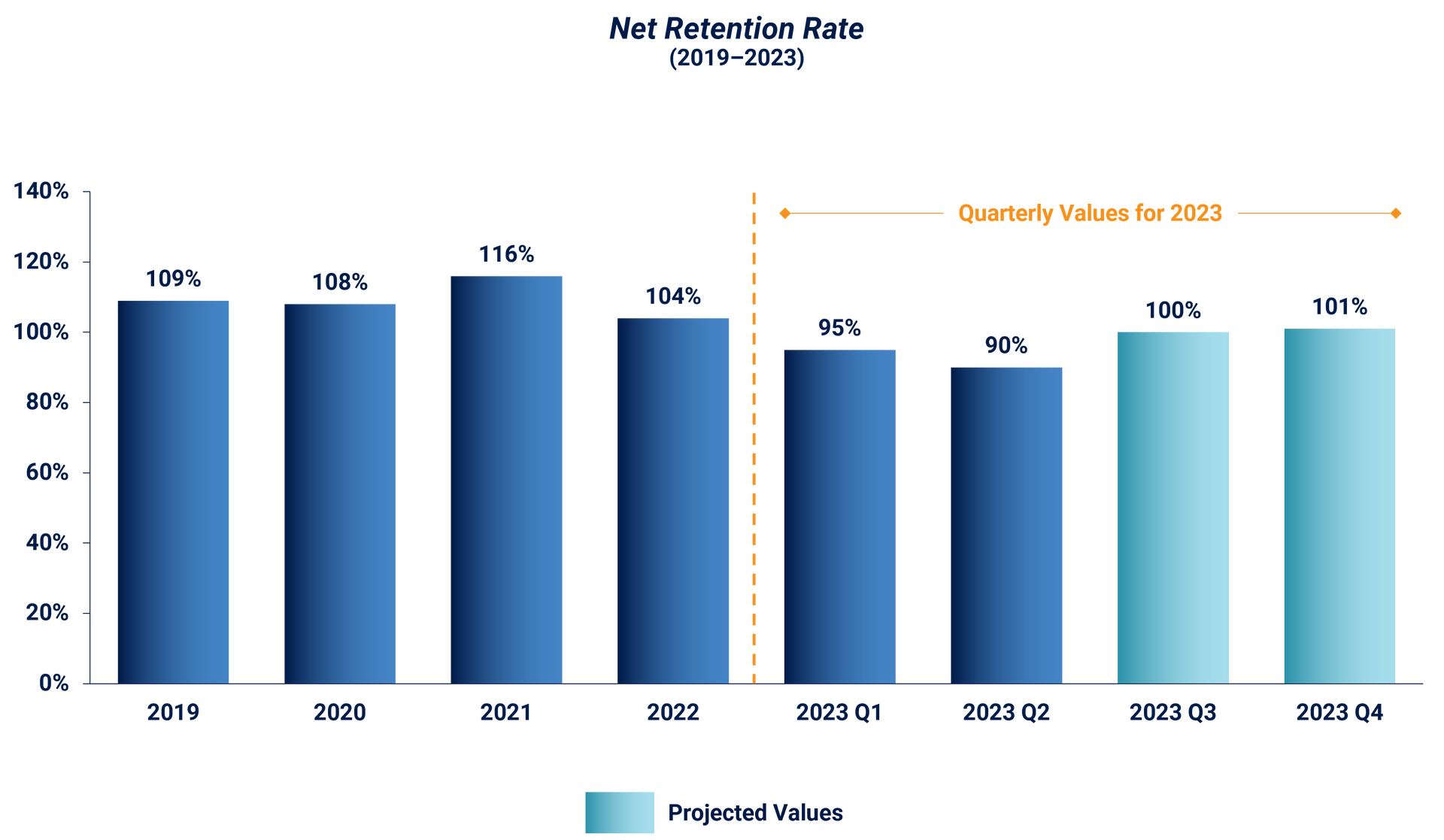

Stax found that the long-term dynamics were favorable as the market still possesses significant levels of whitespace. The short-term horizon presented more of a challenge. The investment target’s solution was critical, but not a core system of record; as a result, the company was still exposed to macroeconomic pressures. Furthermore, as end-customers were optimizing their sales functions, the target company was experiencing a reduction in seat licenses and downgrading of modules, decreasing spend among existing customers and dragging down net retention rates below historical performance.

A deeper dive of their customer base revealed the investment target’s renewals started coming under pressure in Q3 2022. Furthermore, customers previously made significant reductions based on an uncertain economic environment, which drove a decrease in net retention rates. However, as the investment target worked its way through more customer renewals from the previous year FY2022, spend was resuming, driving a reacceleration in topline performance. Our client successfully completed the investment.

Using public companies that have recently reported as a benchmark, other enterprise companies have corroborated this viewpoint. As one example, Microsoft commented “but at some point, workloads just can’t be optimized much further. And when you start to anniversary that, you do see that it gets a little bit easier in terms of the comps year-over-year.”

Conclusion

The outlook for enterprise tech is perhaps more optimistic than recent headlines might suggest. However, while the macro is less of a concern than it was previously, it will still be important for investors to identify the “winners” that have momentum in their categories, as customers have become more discerning in the last ~12 months. Those companies that exhibit secular growth and core growth will be top performers. Stax’s deep expertise helps clients spot these trends and achieve superior returns.

Read More

All Rights Reserved | Stax LLC | Powered by Flypaper | Privacy Policy