Managing, Investing, and Exiting Companies Experiencing Accelerated Growth During a Covid Economy

Managing, Investing, and Exiting Companies Experiencing Accelerated Growth During a Covid Economy

Managing, Investing, and Exiting Companies Experiencing Accelerated Growth during a Covid Economy

Management teams fortunate enough to see pockets of growth in the Covid-economy are grappling with how to leverage a Covid-related increase in revenue, for their short-term and long-term planning. In many cases, they are also asking us how this growth could play into exit planning. Investment teams are similarly asking about how to view Covid-related increases in revenue for commercial due diligence and theme development. An updated framework is needed, and it needs to be populated with refreshed information to deliver actionable insights.

Both management teams and equity sponsors seeing pockets of growth are asking us similar questions:

- What is temporary and what could be permanent, and how do I get the data, insights and guideposts to know what will last?

- How can we get the information and insights fast enough to make valuable short and longer-term decisions?

- Knowing the possible outcomes, what tradeoffs should we consider?

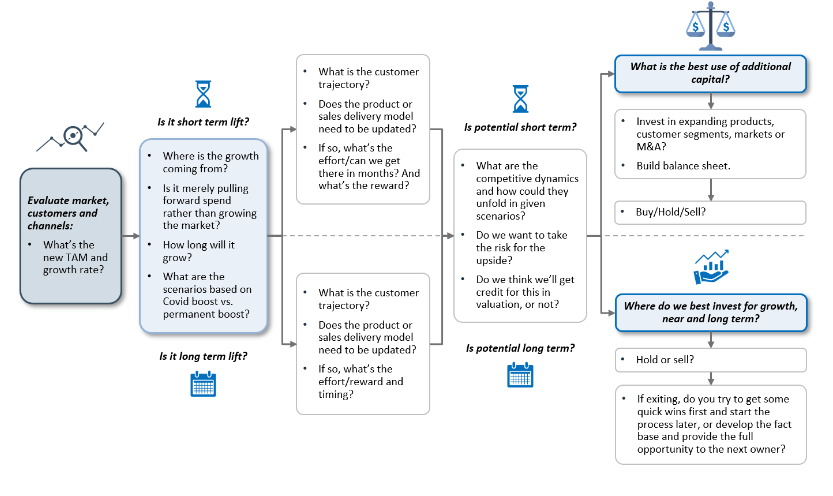

The following is a straightforward framework for evaluating the current situations.

Evaluating the Covid increase in revenues for short-term, long-term, and exit planning

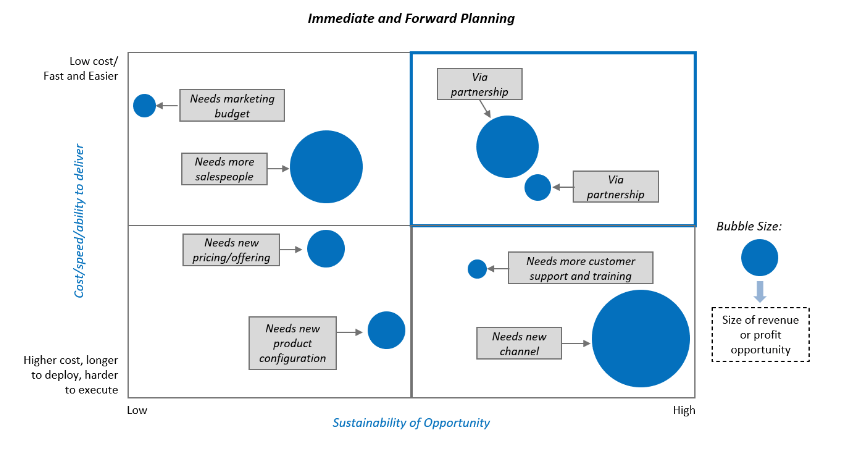

Plotting the tradeoffs: No one wants to miss near-term opportunities to generate income in a down market, nor do investors want to be locked-in or miss the signals identifying where there will be a larger market rebound and unprepared for a long-term period of growth. The matrix below plots the size of opportunity, ease or difficulty of entry, duration of opportunity, and key efforts required to pull it off (risk adjusted ROI/duration). One could use ROI, ability to win share, brand enhancement/dilution, exit valuation, and other measurements within the same construct.

Profit, short and long-term potential

Plotting the emerging opportunities supports the immediate decision making required.

Investment teams, FOMO, and risk: With the greater expectation of a V-shaped recovery, we are already seeing deals come back to market, but it will take time because sellers want to have the EBITDA momentum back before selling, and for all the obvious reasons of market uncertainty and new ways of running a process. In the meantime, anyone with an asset that has a growth story even through the nadir of the V, should see investor interest and be more likely to contemplate an exit given the supply of deals for the demands of dry powder. The data suggests opportunities for companies across these industries, and there are plenty of niches between:

- Consumer related opportunities:

- CPG

- “Around the Home” including building products, home repair, houseware, home entertainment

- Outdoors related

- E-commerce

- Ed-tech

- Pets/Vets

- Business services, industrials, healthcare, and technology related opportunities:

- Logistics, packaging, CPG-related services, ecommerce

- Return to office and remote office

- Collaboration and e-commerce related

- Telemedicine and change of location for healthcare services

- HVAC and air purification

- Data/cloud/collaboration

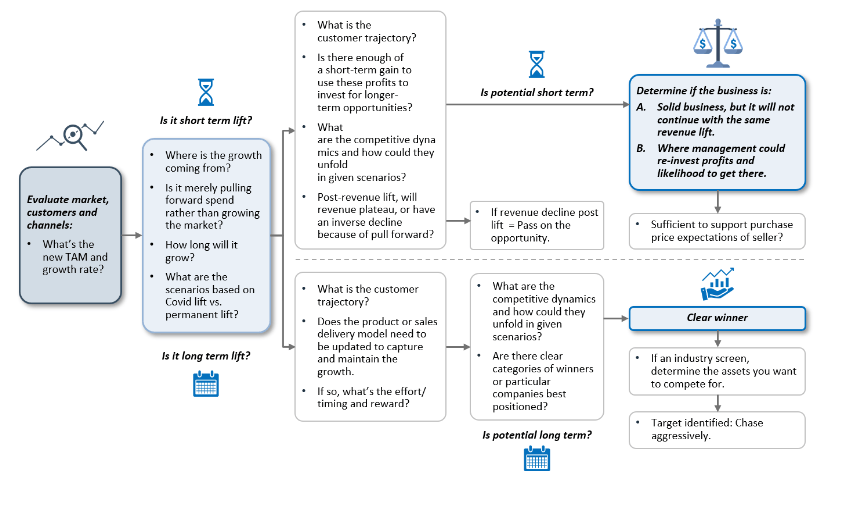

From the early weeks of Shelter-in-Place, Stax has been working with investment teams on theme development and commercial due diligence in areas currently experiencing Covid-related tailwinds. We have also been working on the inverse question for credit funds and private equity clients working on PIPEs, answering if a drop in revenue for a company is short term or will be permanent. The questions are similar: what is short term/long term, sustainable, and what could the landscape look like in 3, 6, and 12 months, and what are the opportunities for companies that have sufficient capital? The framework is almost identical, with different decisions being made.

Evaluating the COVID bump in revenues for investment theme development and commercial diligence

What’s similar in taking this approach, for management teams and investment teams?

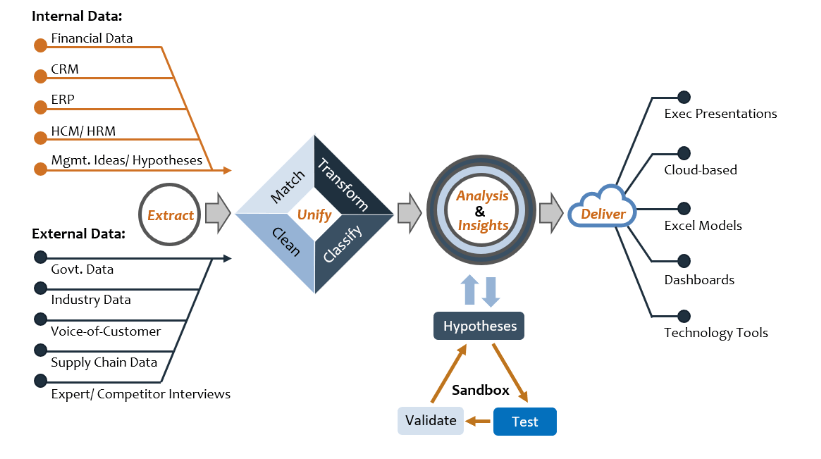

A straightforward framework, with high-quality inputs, and cycles for thinking: Having worked with sponsors and portfolio companies across sectors for 25 years, the working knowledge of a sector gives you a jump forward, but it doesn’t mean you know the answer. Stax’s process for listening to client hypotheses and rapid acquisition of new data allows our consulting teams to run a lot of analyses, even in deal timeframes. This creates the space for more cycles of thinking and discussion with clients to fully process, vet questions, and decide on the best action plans with clarity, even in short timeframes.

Typical Process for Data-Driven Insights

What we see clients appreciate most in the Covid economy is what Stax clients appreciate in non-pandemic-influenced economic cycles: The ability to have a structured discussion around critical market questions and actionable opportunities, with a robust set of facts, and well thought-out set of analyses and insights, and in real time.

Results

- Substantive fact base, for real time, and long-term decisions with clarity.

- Management team and investor team buy-in.

- If one determines an exit - substantive fact base for running a successful process, rapidly, and with certainty.

Contact us for additional information.

Read More

All Rights Reserved | Stax LLC | Powered by Flypaper | Privacy Policy