TSNN Exclusive: Breaking Down the Top 20 Exhibition Organizers List

TSNN Exclusive: Breaking Down the Top 20 Exhibition Organizers List

This article was featured in the Trade Show News Network (TSNN) by Danica Tormohlen.

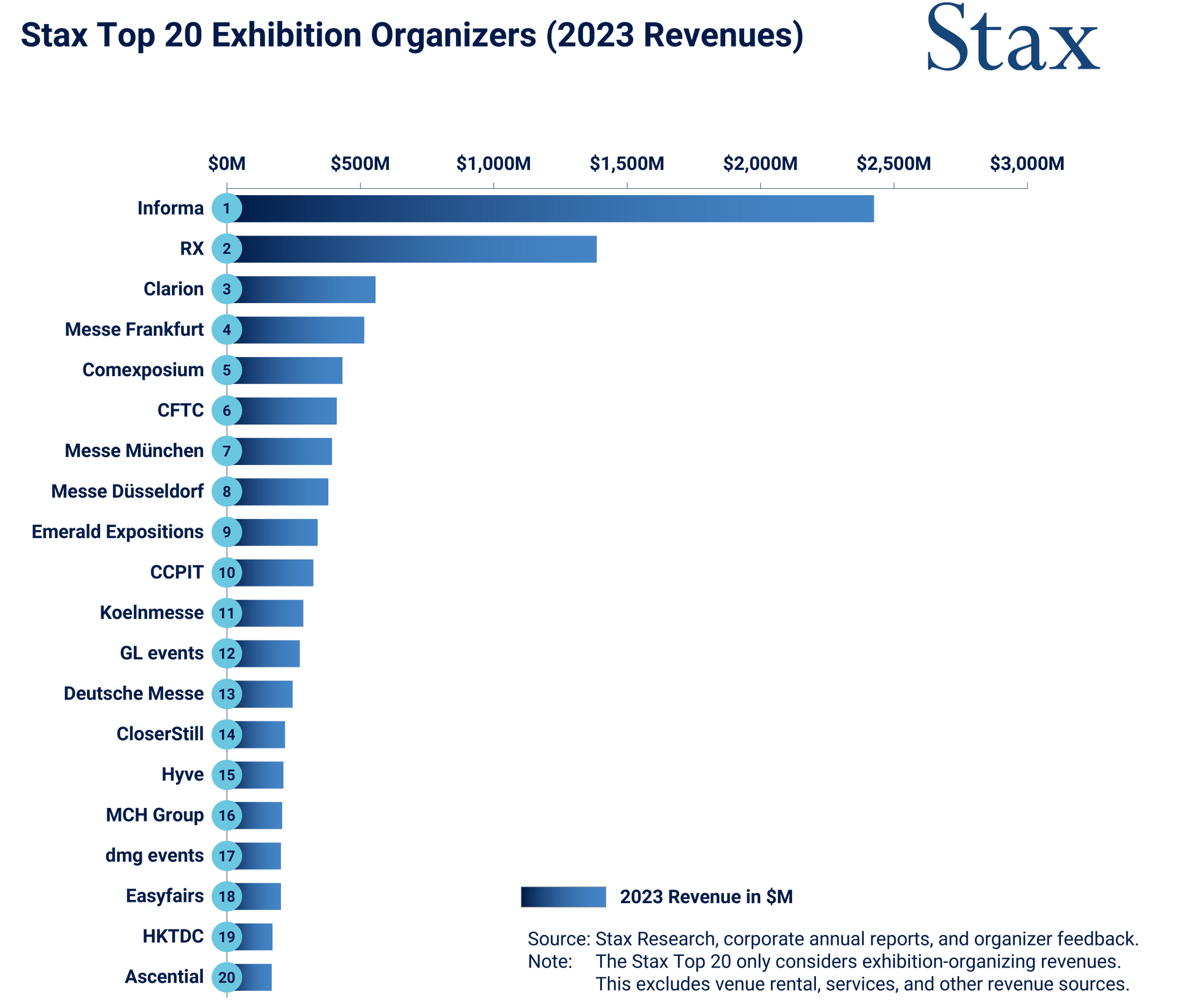

The top three global exhibition organizers by 2023 revenue remain unchanged from 2022, with Informa and RX holding firmly onto the first and second spots while Clarion maintained its presence in third place, according to the annual Top 20 Ranking of Exhibition Organizers released by Stax on Sept. 6.

The combined 2023 revenue from the Top 20 increased by 51% compared to the previous year, a clear sign of the continuing recovery of the industry in 2023, according to Stax. Most organizers achieved double-digit growth, except for a few of the European organizers due to biennial show cycles.

The rest of the Top 20 rankings saw a significant reshuffling, with no organizer retaining their previous year's rank.

Beyond the rankings, we wanted to delve into the history, methodology, and key findings of this year's list. We sat down with Stax Managing Director Florent Jarry and Stax Associate Director Carole Boletti who offered invaluable insights for industry stakeholders looking to benchmark their organizations and understand the competitive landscape of exhibition organizers globally.

Here are highlights from our interview. Watch or listen to the full interview here.

Key Factors Influencing Growth in 2023

We asked about the key drivers behind the 51% revenue increase amongst the top 20 exhibition organizers from 2022 to 2023. Here’s what Jarry and Boletti shared:

1. Acquisitions: Mergers and acquisitions have significantly contributed to the growth, including Informa's acquisition of Tarsus Group (including TSNN) in 2023.

2. Chinese Market: The return of the Chinese market, both in exhibitor and attendee participation in trade shows outside of China and exhibitions within China, significantly boosted the figures. Organizers with a significant exposure to the Chinese market climbed back to earlier positions, propelled by the delayed but strong recovery of the Chinese exhibition market, Boletti said.

3. Biennial Show Cycles: Some organizers experienced slower growth due to biennial event cycles, a trend that is expected to reverse in the coming years.

Remarkable growth

CloserStill made significant gains, climbing six spots from 20th to 14th while dmg events re-entered the list after a two-year hiatus due to COVID-related disruptions. CloserStill’s acquisition of UKI and strong organic growth set it apart in 2023, Jarry said. Meanwhile, dmg events’ growth seems driven by the return of their significant shows and organic growth, he added.

Revenue growth but not as much as others

Easyfairs and Ascential, which had previously shown strong upward momentum, slipped to 18th and 20th places, respectively, despite showing strong revenue growth in 2023.

Ones to watch

In alphabetical order, the seven next largest organizers outside this year’s Stax Top 20 rankings include Arc Network, the Consumer Technology Association (CTA), DLG Exhibitions, IFEMA Madrid, Italian Exhibition Group (IEG), NürnbergMesse and Terrapinn.

Impact of Broader Economic Factors

The broader economic and geopolitical landscape, including inflation, supply chain issues, and global travel hesitancies, has also played a role. These factors have influenced exhibit space pricing, participation levels, and the overall financial performance of organizers.

Origin story

Stax's list, initially named the AMR Top 20, first came into existence in 2016 under the previous company name, AMR. Upon Stax acquiring AMR in 2022, the list continued under its current title. This annual ranking is unique in its focus solely on exhibition organizing revenue, distinguishing it from other industry rankings that might include diverse revenue streams such as venue rental.

Methodology behind the rankings

Compiling this list involves a meticulous process, said Boletti. For publicly traded organizers, data is more accessible, but it requires adjustments to separate exhibition revenue from other income streams. For private companies, Stax utilizes project-based data, industry expertise, secondary research, and annual reports to compile accurate revenue figures. Before publishing, Stax reaches out to organizers for validation, ensuring the data's accuracy and confidentiality.

What is measured

The list exclusively tracks revenue tied to specific events organized by the companies. These figures include exhibitor sales, digital revenue, sponsorships directly linked to exhibitions, and ticket sales, excluding venue rentals and other non-exhibition services.

Looking ahead

How will next year’s ranking change? The landscape of next year’s Stax Top 20 is anticipated to be influenced by continued mergers and acquisitions. One thing is certain: The integration of Ascential by Informa is expected to solidify its leading position further—if the deal closes as planned in 2024. The departure of Ascential will open up opportunities, and with several organizers on the brink of substantial growth, the rankings could see fresh faces aiming to make their mark.

Read More

All Rights Reserved | Stax LLC | Powered by Flypaper | Privacy Policy