Utilizing Data to Forecast Performance During Times of Uncertainty

Utilizing Data to Forecast Performance During Times of Uncertainty

During these unprecedented times, businesses need data to forecast potential outcomes and navigate market turbulence and project ‘the bottom.’ If it’s a portfolio company or a credit situation, companies are trying to figure out how bad things will be and modeling out the data is critical. By performing a temperature check on an industry or the business through analyzing data to predict the floor, companies will make better decisions to rightsize the business and get ahead.

Similar to the Great Recession (2008 – 2009), Stax is currently being asked to help portfolio companies model and forecast their range of performance scenarios to help resource and cost planning. We are supporting fundamentally good businesses that may be challenged by a changing mix of companies/customers in their addressable market, changes in behavior among customers (temporary or permanent), and potential pricing and margin challenges (given competitive dynamics). While trying to project the bottom is not as enjoyable as focusing on growth, it provides businesses with a realistic expectation of potential decline, and identification of potential mitigants, so they can be making informed decisions.

Forecasting an Industrial Sector Company’s Projected Sales Growth

Stax was engaged to develop an independent, data-driven perspective for an industrial sector company into projected 2008-2010 end-market purchase growth to enable budgeting and forecasting of the company’s performance. In addition to primary research, we analyzed a variety of factors to predict estimated growth forecasts.

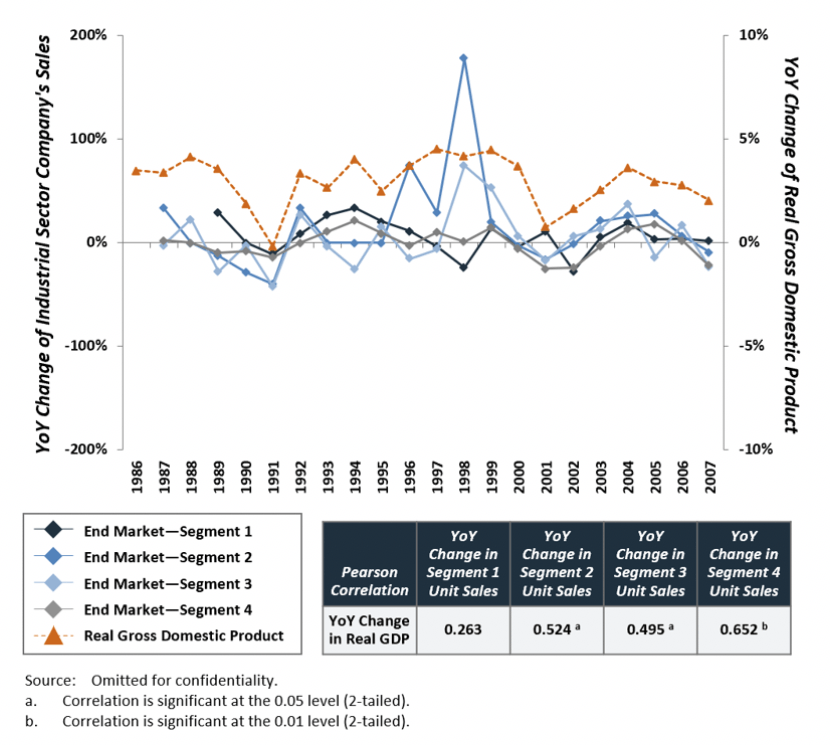

The data showed that there was a high correlation between YoY change in real GDP Growth and YoY change in end-market segments 1, 2, 3, and 4; and any change in GDP correlated to change in end-market segments (1, 2, 3, 4) with statistical significance (Figure 1).

Figure 1: YoY Change in Industrial Sector Company’s Sales vs. YoY Change in Real GDP, 1986-2007

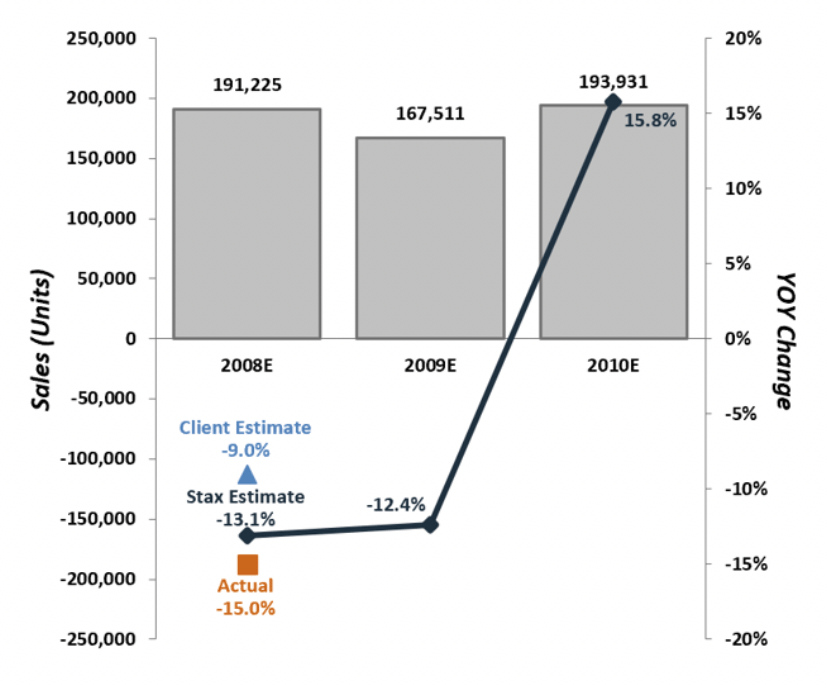

Utilizing the predicted YoY changes in real GDP, housing starts, and fuel prices, Stax developed a regression model to forecast sales of end-market segments 1, 2, 3, and 4 (Figure 2). The primary research with a substantive number of customers highlighted replacement needs which would give a floor to the market and could triangulate with the historical model. Stax estimated a decline in the 2008 sales forecast of –13.1% (vs client estimate of –9%). Given the actual at –15%, our more conservative perspective on the market allowed the management team to better plan for their operations and have a concrete conversation with investors and was well-positioned for a successful run going forward.

Figure 2: Estimated Sales Forecast

By capturing key qualitative and quantitative data, we were able to provide the company with growth outlook for specific end-market segments in the next year, with a high degree of transparency in our estimates. Through a fast-paced, data-driven process, we delivered actionable insights to address management’s key questions and forecasting needs.

Read More

All Rights Reserved | Stax LLC | Powered by Flypaper | Privacy Policy