Forecasting the Long-Term Impact of Telemedicine

Forecasting the Long-Term Impact of Telemedicine

Introduction:

Given the revenue constraints healthcare providers are seeing due to Covid-19, they need to reforecast the year and look for the best possible growth avenues near term, and long term and telemedicine should be at the top of their lists. Telemedicine adoption is taking a rapid step up and should continue growing quickly. Beyond the short-term boost telemedicine is receiving because of shelter-in-place restrictions, there are a handful of constraints to adoption that have been forced open, including regulations, inertia of payors and providers, and training.

Infrastructure and remote/rural access may also get a boost from additional stimulus funding. Since the realization of Covid-19 risk, these constraints have been thrown open, requiring significant investment to ramp to satisfy customers and win or maintain share. There is potential for high long-term returns to short-term ramp to gain share. All this activity also expands opportunities for telemedicine technology and service providers.

Stax is currently in-field, collecting data on customer behaviors, perceptions, and expectations to update our modeling inputs at a national level. Following are some initial facts and insights, six weeks post the first shelter-in-place policies in the U.S. Initial trends illuminate drivers of the current step function growth, potential for sustained future growth, an increased competitive environment, and why more investment should follow. In this and subsequent analyses, we will continue to review consumer interest, private pay, government interest, and provider investment, along with framing out the best way for providers to think about opportunities and risks. Having provided clients with high-accuracy models on forecasting patient volumes for more than 20 years, we use the national levels as examples, and dive deep at a local level with clients to surface actionable insights and the most relevant perspective.

Emerging Trends

Increasing consumer demand – spike in searches/traffic:

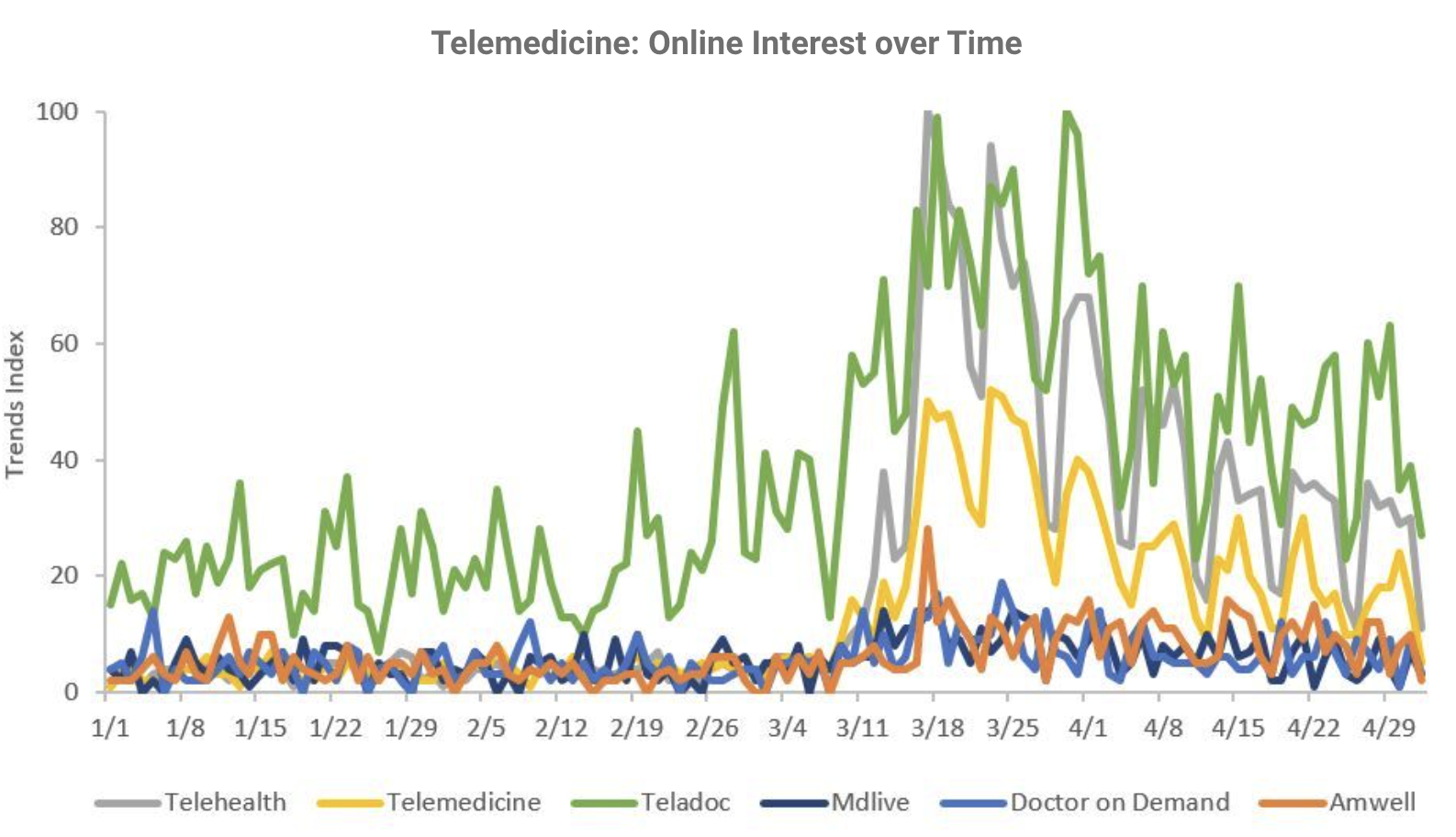

Web-based searches for telemedicine and telehealth spiked in March and included both general and branded company searches. General keywords telemedicine and telehealth saw a spike of 10x-15x in March in the Google Trends Index since January-February levels and have settled down to about 5x-7x in April from these levels. Teladoc (one of the largest telehealth companies in the U.S.) also saw a 3x spike in March in the Google Trends Index and is still at 2x levels in April as compared to index data in January-February. In April, Teladoc also saw almost an 80% increase in mobile application downloads from the second week of March highlighting the action steps taken beyond the searches. These downloads could be for Covid or non-Covid related visits, but regardless, the app is now on a lot more phones, which will ease future use.

HR Executive Survey

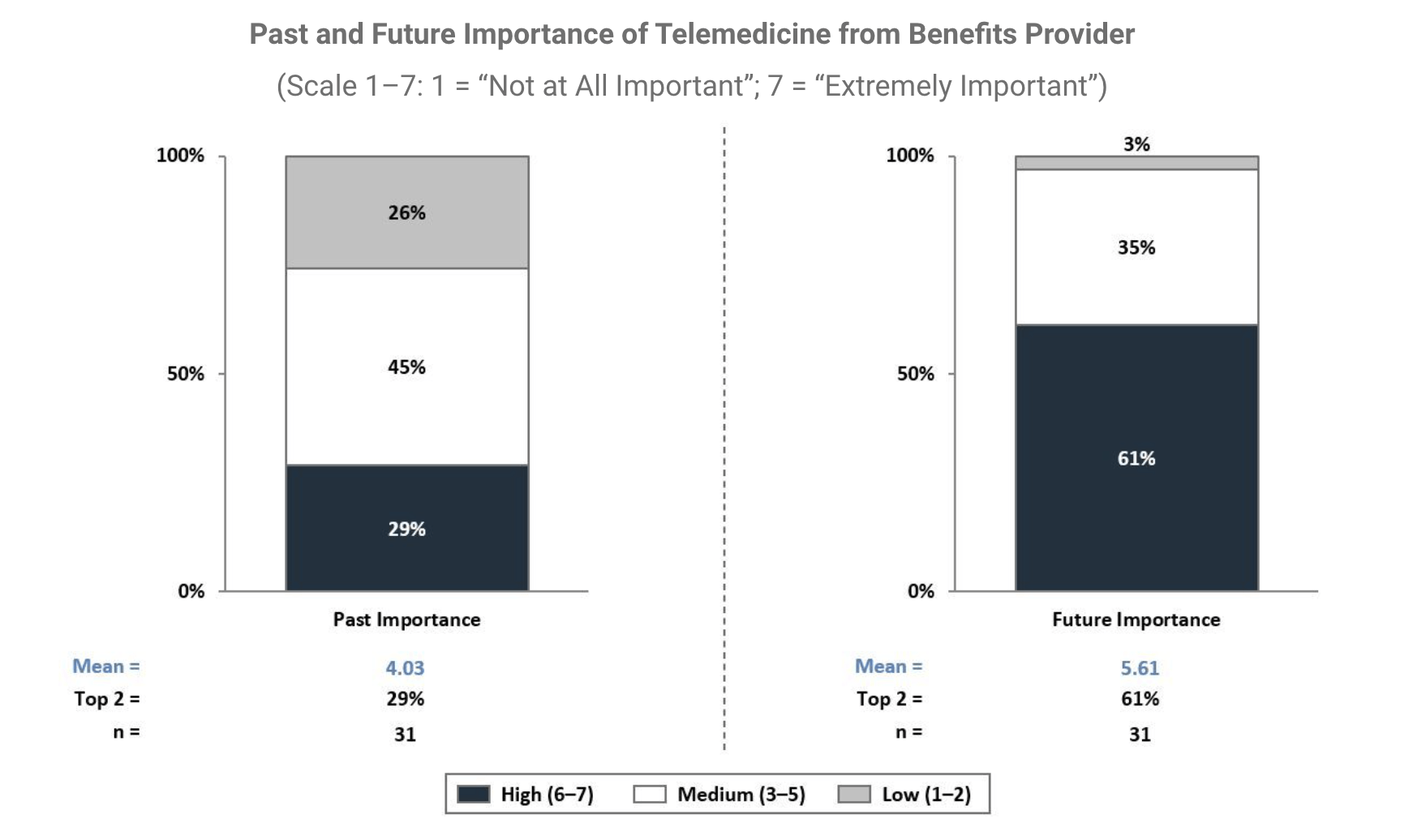

A Stax flash survey of HR executives conducted in late April 2020, highlights the growth and expected permanence in telehealth. When HR executives were asked how important it was in the past for their benefits provider to offer telehealth, compared to their expectations of future importance, twice as many respondents said it is extremely important now, compared to their historical views.

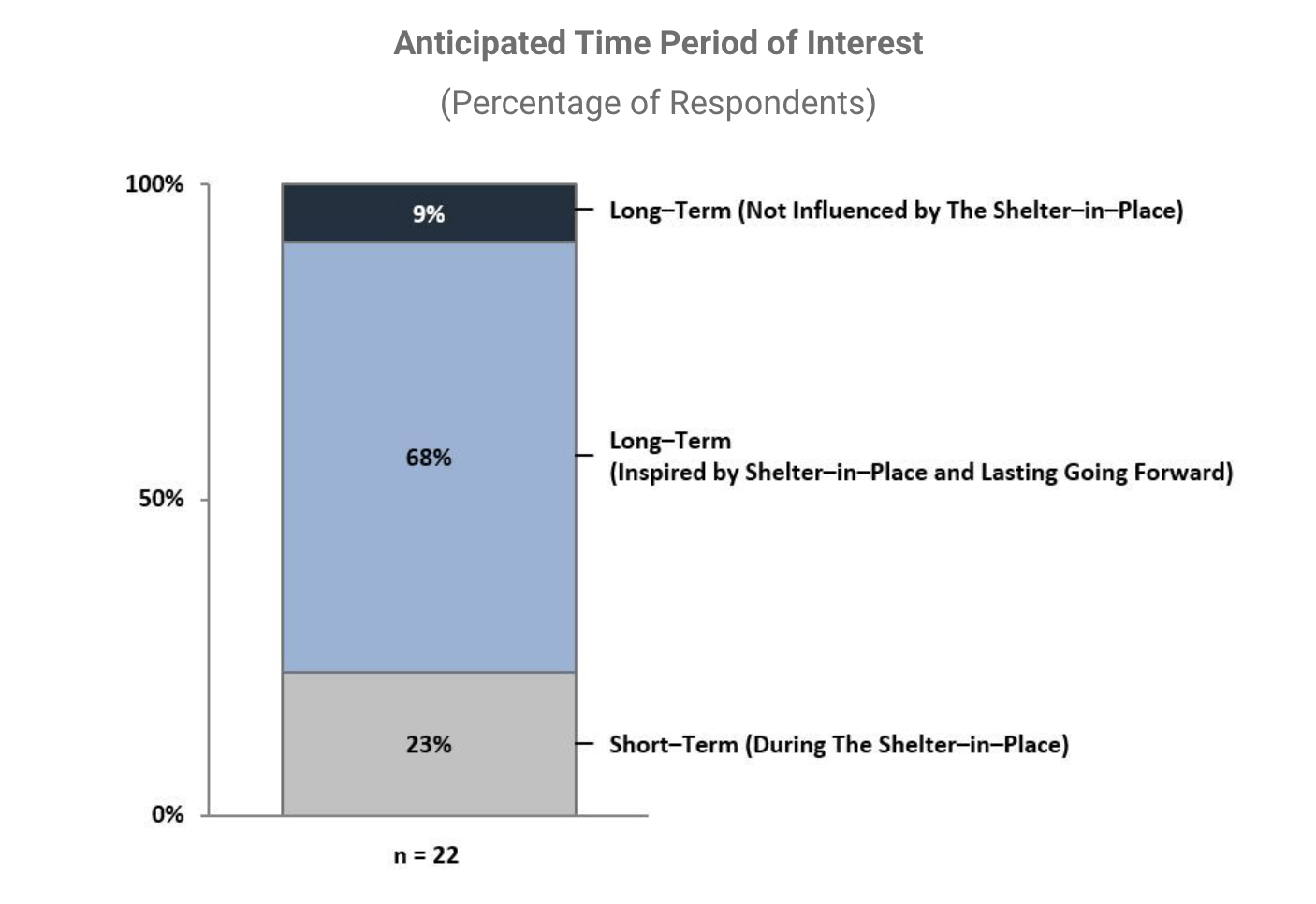

When asked if they think telemedicine growth will be short term due to Shelter-in-Place or more permanent, 23% of respondents thought it would be short term, and 77% thought it would be a permanent change, mostly inspired by Shelter-in-Place, but likely taking hold long term.

Dramatic jump in telemedicine sessions:

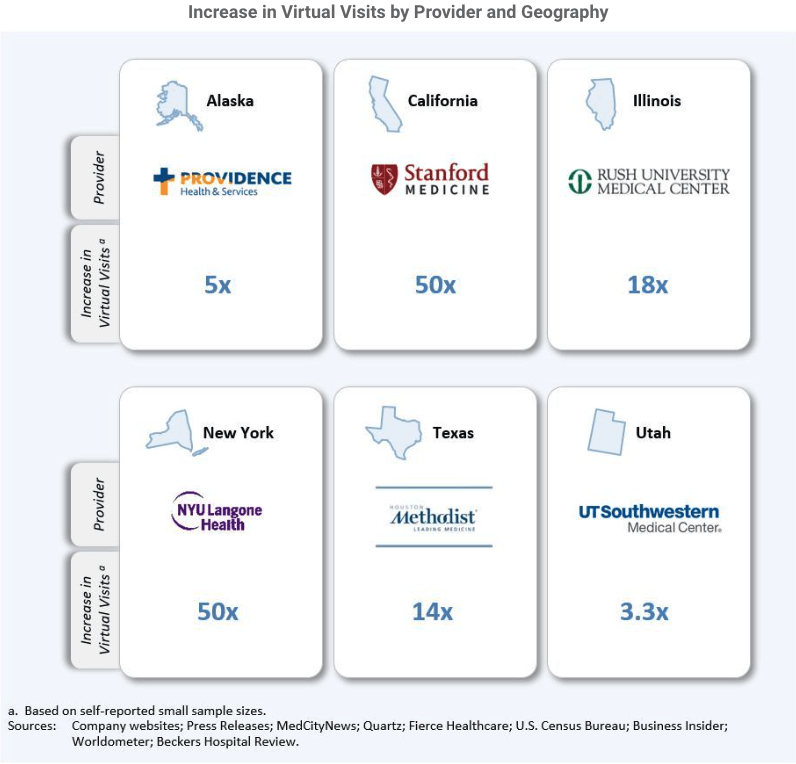

Between March 12 and April 9, 21 providers across 12 states self-reported increases of virtual visits. Those providers’ increase rates roughly bucketed into ranges from 2.5x-5x and 15x-50x. One must presume that some of the spike is from patients calling about whether they have Covid-19, which may or may not be a short-term change in volume and may spike further depending on testing availability and protocols. While this isn’t a perfect sample, an additional observation about these self-reporting providers is that results were consistently high across states with high, medium, and lower regulatory hurdles for telemedicine.

Rapid regulatory easing:

Even before Covid-19, most states were easing regulations around telemedicine but at varying speeds. Stax classified states by the regulatory hurdles as high, medium, or low. To do this, we considered a wide variety of parameters, such as Medicaid regulations across live video, storing and forwarding patient information, remote-patient monitoring, private payer laws, consent requirements, and cross-state licensing. As of January 2020, examples of state classification with low regulatory hurdles were New York and California, those with moderate hurdles included Illinois and Texas, while an example for a high regulatory hurdle state was Massachusetts. According to Federation of State Medical Boards (FSMB) in response to Covid-19, as of April 10, 43 states have made some sort of emergency relaxations in telehealth regulations, and there is potential for further reduced regulation on practice across state lines, which opens supply and cross-state competition.

Examples of Regulatory Easing

California has relaxed state rules allowing healthcare providers to use telehealth and tools such as Skype and FaceTime without risk of penalty. Texas waived certain telemedicine regulations and directed the Texas Department of Insurance (TDI) to issue an emergency ruling, requiring insurers to pay the same amount for telemedicine services, including covered mental health services, as they do for in-person services. The rule applies to in-network services for state-regulated health plans. West Virginia, the last state to report a case of Covid-19, has broadened the use of audio-visual telehealth for non-emergent E&M services to Medicaid members and in Federally Qualified Health Centers (FQHCs) and rural health clinics (RHCs).

Increase in trained providers, infrastructure, and customer education:

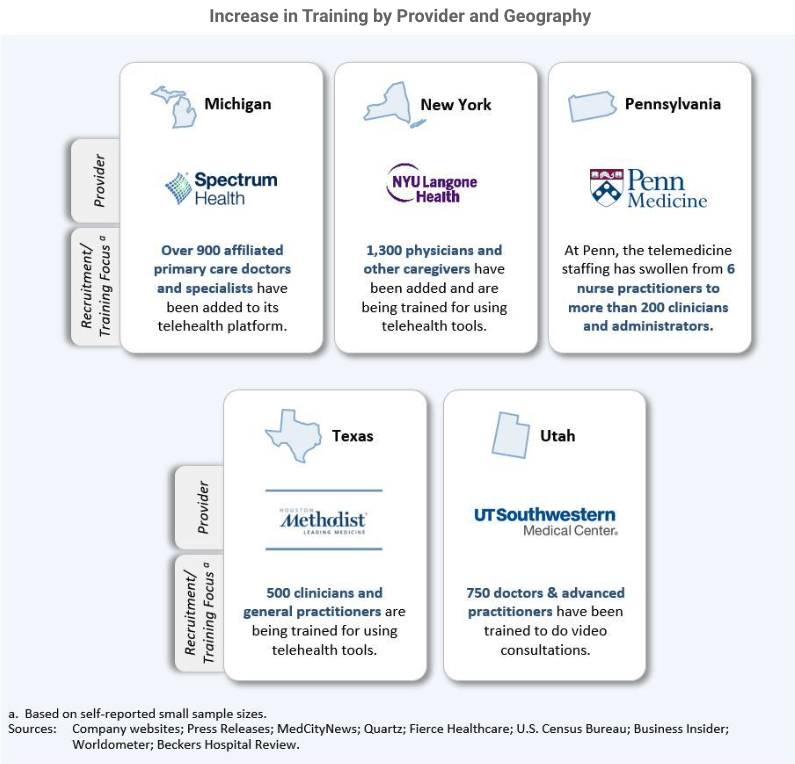

From the beginning of March through mid-April, nine hospital networks with 180+ hospitals in their collective systems, across seven states announced over 5,000 additional doctors/caregivers were being trained on telemedicine. Highlighting that providers are counting the numbers and their communications teams are ready to share this with the press – so it is top-of-

Houston Methodist recently opened its new Center for Innovation's Technology Hub in January 2020 and has already trained over 500 doctors both onsite and digitally. The hospital has reported since the beginning of March, there were 66 providers offering virtual care, and by March 25, there were over 900 providers operating virtually.

mind for management. A sample of 180 hospitals out of 4,500 acute-care facilities across the U.S. doesn’t mean that you can use this 4% of market participants’ expansion to forecast a whole market, but the data is out there to advance our models, and a growing factor will be the market permeability of these services. The graphic below highlights substantive players, across states with varying healthcare regulatory environments and stay-at-home mandates, all expanding and promoting their telemedicine initiatives.

Potential additions to supply:

The additions to the healthcare labor supply include the typical return of nurses during a recession, volunteers coming out of retirement to assist cities during the Covid crisis, and easing of cross-state practice and physician re-entry laws.

Stax’s analysis has shown that in past recessions, more nurses come back into the labor pool given the need for additional income or as a second breadwinner. The speed of the economic shock and the reality that savings for many Americans is so low, will encourage more retired practitioners to go back to work. As of April 7, 29 states had issued guidelines waiving some of the requirements for reentry into practice and thousands of practitioners are coming out of retirement across the country, volunteering outside of their home state, to help cities with outbreaks.

Our work across healthcare highlights clear segmentation between those who want to move for their work and those who would prefer to work within a defined, convenient radius. The easing of cross-state practice laws, combined with telemedicine now opens more ability to practice remotely, and may encourage many of these short-term returners to become more permanently re-employed in healthcare.

While to-be-determined if states rescind the emergency regulations, the longer these regulations are in place, the more likely they will stick. States will also have greater interest in anything that allows for lower cost healthcare, given the massive financial burden and debt load they will have for a long time to come due to increased costs and eviscerated tax income in 2020. Given where we are, it is hard to see any rebound that would reduce access or increase costs in telemedicine going forward.

Population changes, requiring healthcare at lower costs:

With the national unemployment going to 13% as of this writing, and a substantive shift in payor mix, there will be increasing pressure to provide cost-advantaged services. We’re already experiencing a massive increase in stay-at-home care, and with forward financial burdens, this will stay high for a while.

Additional access in “medical deserts” and potential for sustained regulatory change:

Government data shows nearly 80% of rural America (home to 20% of the U.S. population) is medically underserved, with fewer than 10% of its doctors. Couple with the fact that 26% of Americans lack high-speed Internet, the recent introduction by House lawmakers of the Healthcare Broadband Expansion During Covid-19 Act would infuse $2 billion to expand remote treatment options and ensure high quality internet connection at health care facilities through the FCC’s. This capital would bolster the FCC’s Healthcare Connect Fund Program (HCFP) and streamline administrative requirements and expand the program further to include rural, urban, and suburban healthcare providers.

Technology changes:

While it may seem strange to put technology towards the end of the trends section, technology hasn’t been the biggest hurdle. A handful of technologies here illustrate the potential for medical staff to do more remotely, including technologies such as PACS (Picture Archiving and Communication Systems), diagnostic telehealth tools, and providers offering online platforms/mobile applications for helping patients access their data and secured virtual real-time calls. Following are a few examples of specialties where telehealth tools are increasingly being adopted and representative players in those fields:

Specialty/Focus Currently used Telehealth tools

- General

- Web portals and platforms for secure real-time video calls

- Hospital-to-hospital communication using secured emails and video calls.

- TeleConnect and TeleConsult programs utilized for interactions between Boston Children’s Hospital and community hospitals

- Pediatrics

- Tytocare

- Handheld exam kit and mobile application at the patient site allows doctors to perform remotely guided medical exams such as body temperature, heart rate, images of ears, throat, and skin

- Locus Health

- At-home pediatric monitoring software platform (iPad equipped with software) utilized to post ER discharge of infants to communicate vital health information (weight, heart rate, food intake, and oxygen levels) in real time with the doctors.

- Vivify Health

- Mobile application with monitoring kits Mobile application with monitoring kits (tablet with an unlimited data-plan) to track and report a baby’s health metrics (such as weight, pulse, and oxygen saturation) with remote monitoring from the doctor’s side.

- Vivify also offers mobile platforms to general patients to remotely monitor other parameters and host video calls with doctors.

- Ophthalmology

- iCare USA

- iCare Home Tonometer utilized at patient site for remotely monitoring patients’ intraocular pressure (IOP) which is retrieved by the doctor through the iCare clinic software.

- EyecareLive

- Telemedicine platform (mobile application) for ophthalmologists and optometrists for monitoring of treatment plans in real time, sharing eye images, and hosting video calls.

- Dermatology

- SkyMD

- Telemedicine platform (mobile application) for real-time conversation between patients and dermatologists for monitoring, sharing images, and video consultations.

- VisualDX

- Educational and Diagnostic Aid web portal uses machine learning for matching patient symptoms with millions of photos for dermatologists to improve the accuracy.

- Cardiology

- InfoBionic’s MoMe Kardia System

- Cardiac monitoring device used by patients with cardiac diseases to share data with doctors regularly and remotely via a web-based platform

- G Medical’s Smartphone case

- Smartphone case that remotely monitors capabilities include ECG, health rate, body temperature, and stress levels; since Sept. 2019 utilized by over 5M patients worldwide.

- BioTelemetry’s Mobile Cardiac Outpatient Telemetry (MCOT) Patch Cardiac monitor

- An arrhythmia monitoring detection device providing up to 30 days of near real-time remote monitoring for doctors.

- It is the only cardiac monitor proven to detect AF (≥ 30 seconds) with 100% sensitivity and 100% positive predictivity.

- Qardio

- Remote blood pressure, ECG, and weight monitoring devices paired with Qardio app utilized by patients; data is automatically analyzed and presented to doctors via a web-based platform.

Real-time planning, whether you are a payor, provider, or investor:

While the shock to the system is giving telemedicine a huge lift, for all of the above reasons, it will emerge in a much larger and more prominent role. Telemedicine is not a zero-sum game. In many instances, it will increase total volume even if at an average lower cost, but with opportunity, comes greater competition. Payors and providers are currently focused on the short term and will need to start looking quickly to the mid/longer-term implications of behavior and competitive changes. Telemedicine must be part of both the short-term and long-term solution, and while the world is going to be dealing with Covid-19 in some capacity for the next six months and in that timeframe, competitive dynamics can play out and earlier movers, better planners, and those executing well will really gain an advantage.

For providers and investors in provider businesses, there are number of critical elements to consider to best position to both defend and gain from the change in behaviors:

- Review of services lines, updated forecasting volume, reimbursement changes, and the impact of behavior changes such as telemedicine

- Review of profitability by service line and forecast for future relative contribution

- Optimization/reallocation of capital investment, staffing, and hiring plans

- Understanding of employer, patient/caregiver/corporate, and provider behavior change

- Detailed, local level understanding of competitive changes, opportunities, and threats

For managed care businesses and those that serve them with services and software, the focus is around understanding behavior change and its implications:

- Understanding of employer behaviors and changes

- Understanding of individual consumer behavior change and persistence

- Understanding of provider perspective and changing behaviors

- Evaluating competitive actions and benchmarking

For all healthcare companies and investors, an understanding of the evolving attitudes and behaviors that have changed with respect to telemedicine and beyond, is critical to positioning in the short term to help lock in gains from beneficial changes and to position competitively to best serve members, patients and providers in the future. Stax is immersed in ongoing evaluations of these changes – stay tuned for additional insights and call to discuss how we can apply our data-driven approach to helping your organization navigate the disruption to find and secure opportunities.

Contributors: Rafi Musher, Mark Bremer, Rob Larson, Himanshi Baranwal, Ali Marikar-Bawa, Laisha Mirpuri, Prashanth Jayasekara , and Anupa Wickramarachchi

Read More

All Rights Reserved | Stax LLC | Powered by Flypaper | Privacy Policy